LMS Empowering Financial Teams For Growth

e-KHOOL LMS is designed for diverse financial teams, from microfinance officers to compliance auditors, helping them gain knowledge, stay compliant, and serve clients better.

Credit Officers Improve Loan Processing Skills

Credit officers can learn loan eligibility assessment, documentation, and risk management through interactive e-KHOOL LMS modules to follow standardized credit procedures.

Collection Teams Strengthen Recovery Management

e-KHOOL finance LMS modules focus on ethical collection practices and communication skills, reducing default rates and maintaining customer relationships.

Finance Managers Develop Strategic Leadership Skills

e-KHOOL LMS helps managers stay informed about emerging financial technologies, market regulations, and customer needs, empowering them to lead teams effectively.

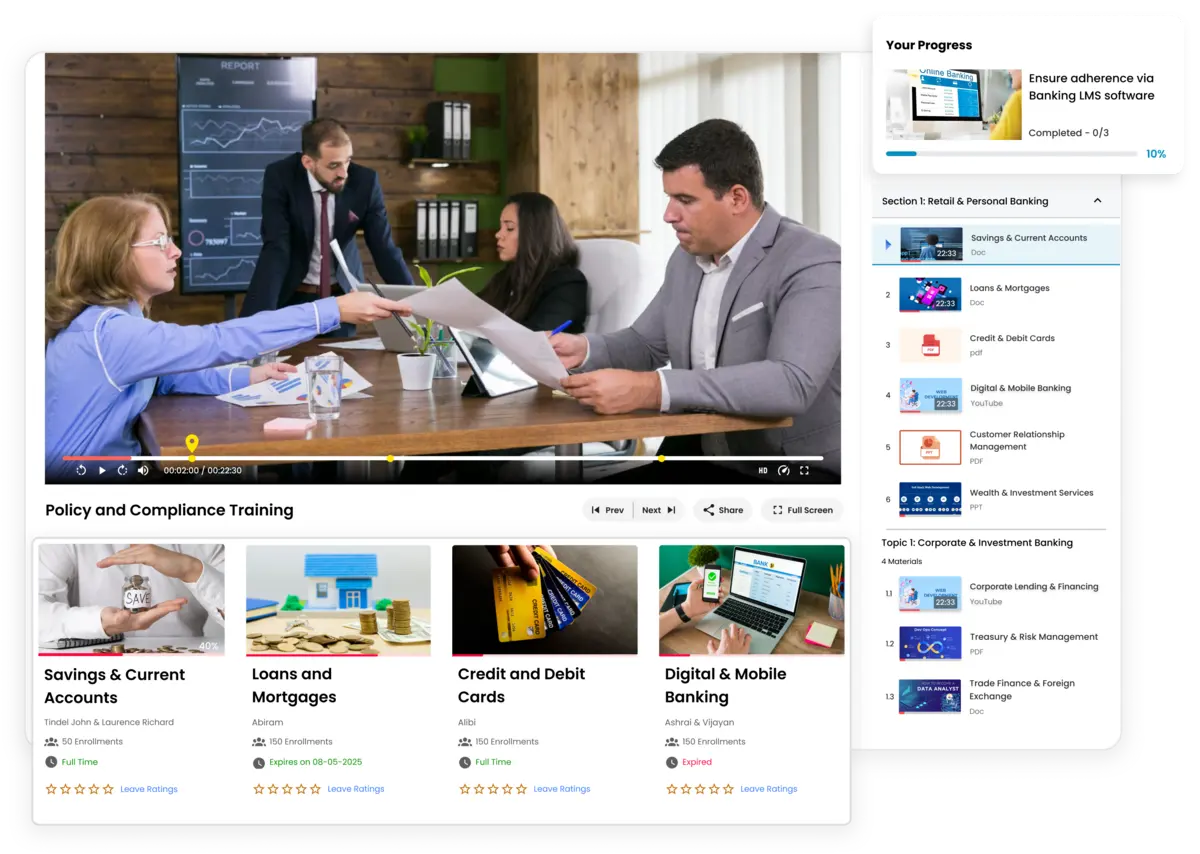

Policy Drafting & Audit Team

Accessing centralized training modules on regulatory standards, documentation protocols, and audit compliance, the team can stay updated with the latest policies, schemes.

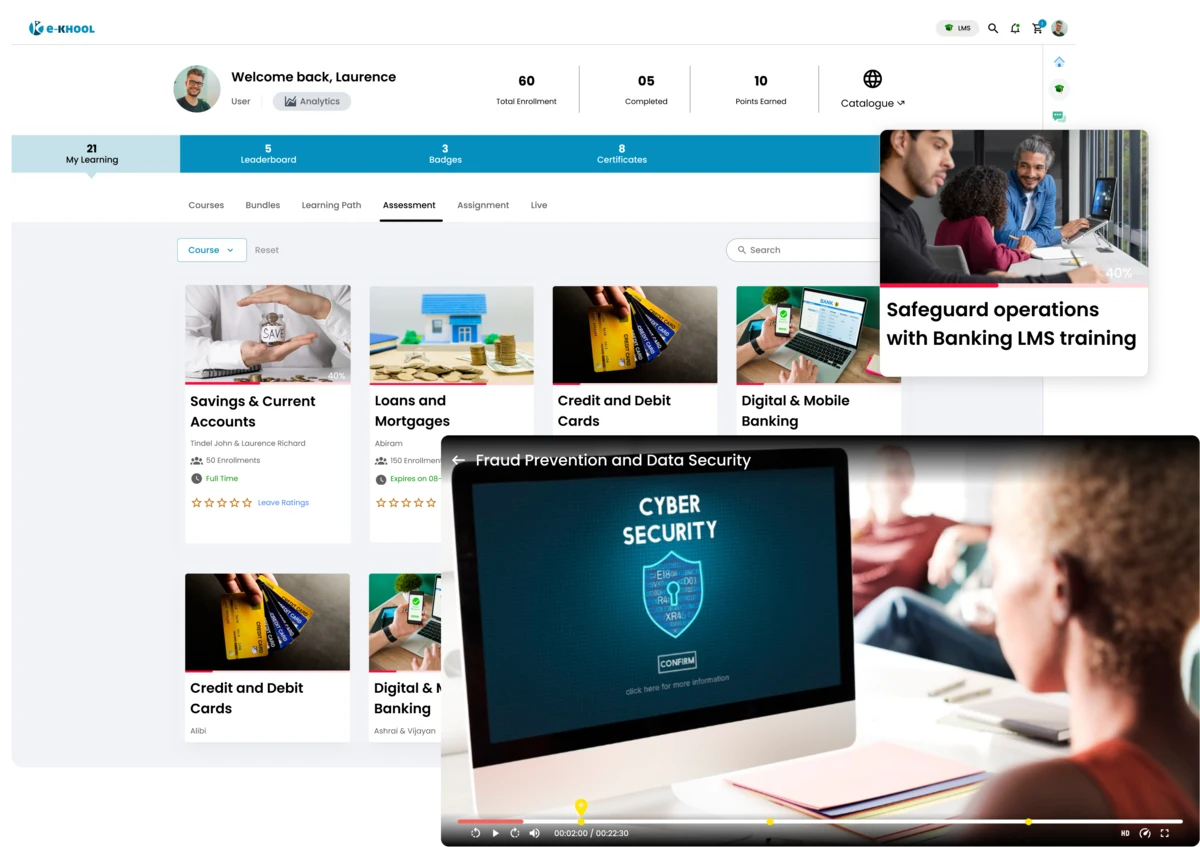

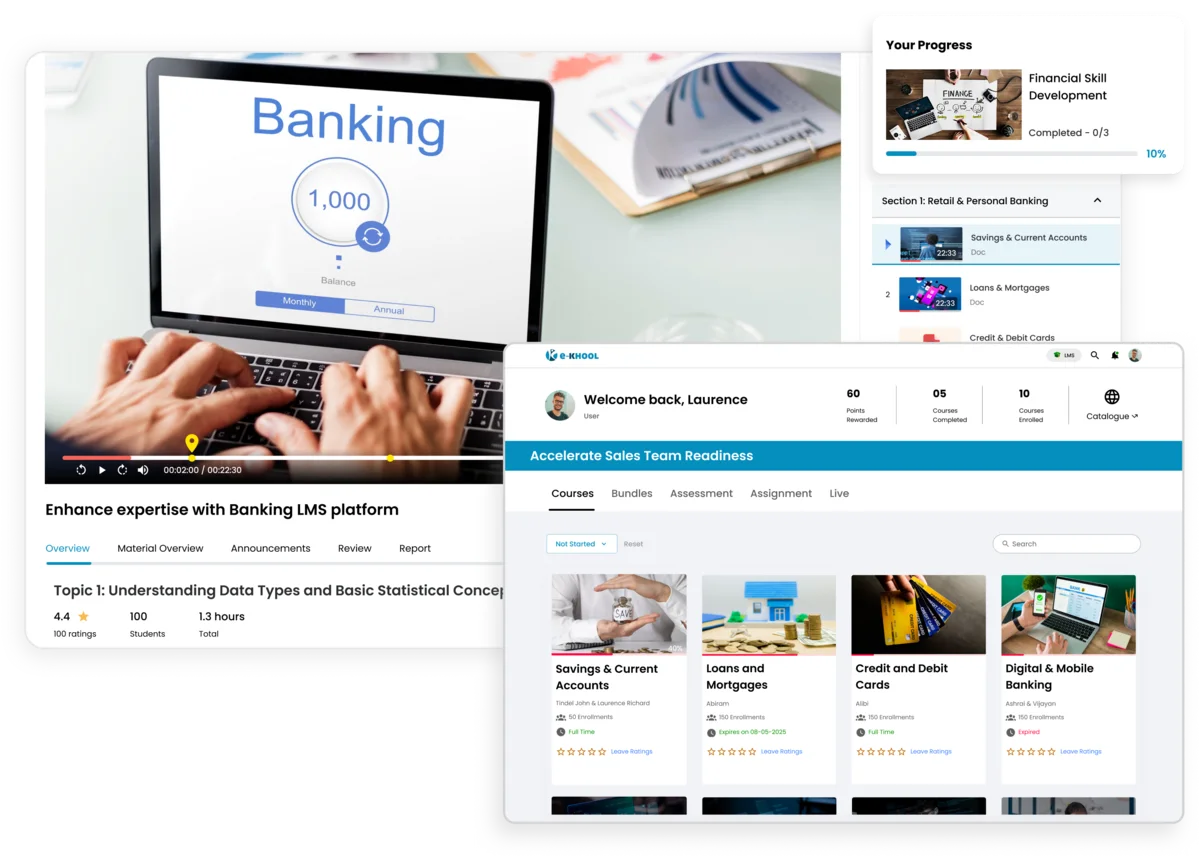

Upskill Finance Workforce With e-KHOOL LMS

e-KHOOL LMS provides finance companies and microfinance institutions with a platform for scalable, compliance-ready, and digital training.

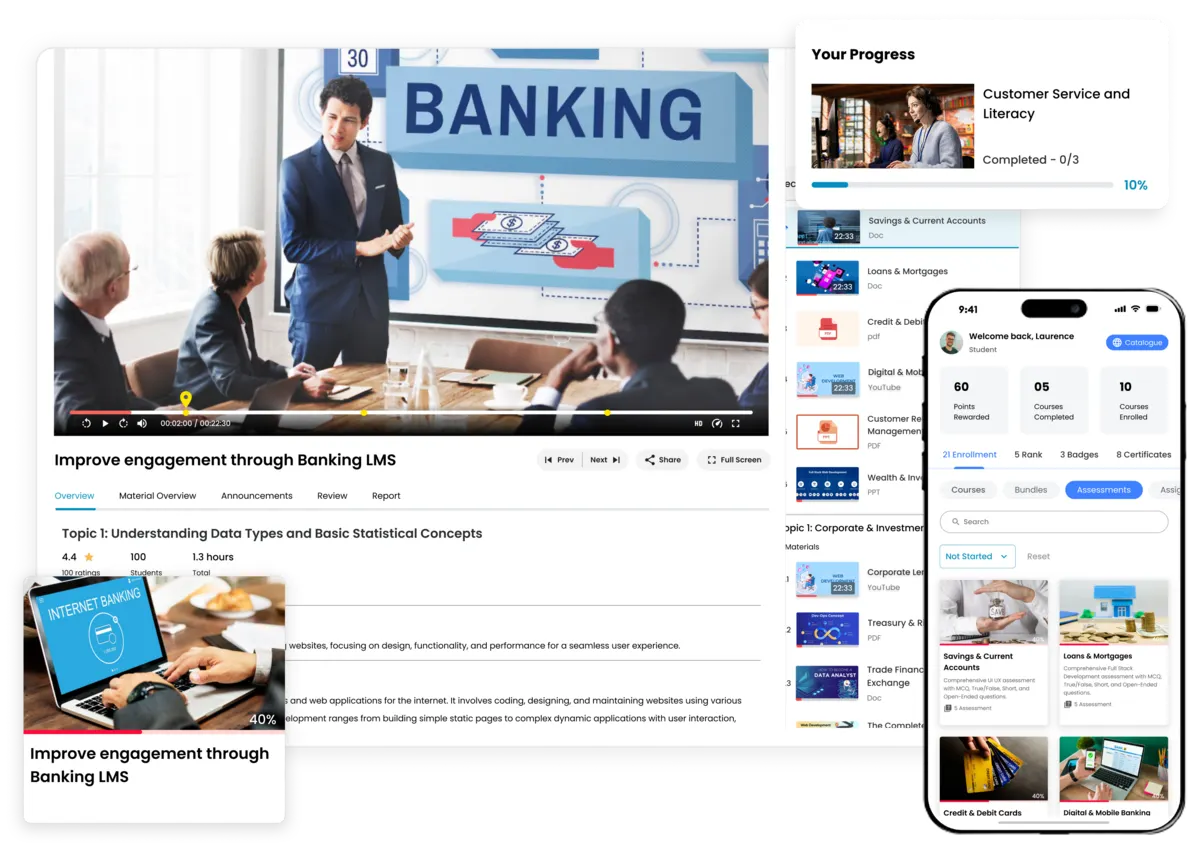

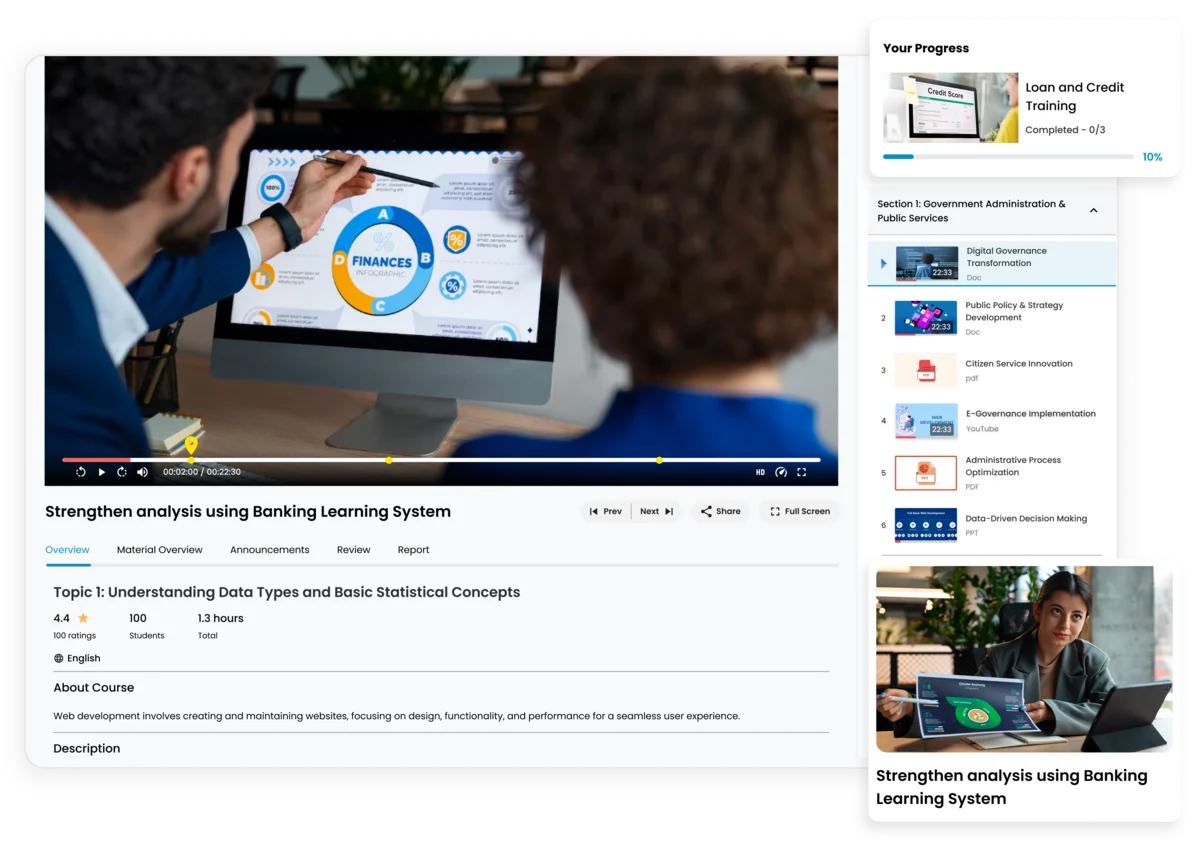

LMS Features That Empower Financial Institutions

e-KHOOL LMS offers AI-powered tools, analytics dashboards, and mobile learning tailored for financial institutions ensuring that employees at every level are trained, assessed, and compliant.

Compliance Tracking And Reporting Tools

The platform automatically tracks course completions, certifications, and updates. Real-time dashboards help compliance managers monitor adherence and generate reports for audits.

Mobile Learning For Field And Branch Teams

Field officers and branch employees can access learning materials anytime using mobile devices. This ensures flexibility and continuity of training, even in remote areas.

Custom Course Creation And Certifications

e-KHOOL LMS enables easy upload, tracking, and certification for completed courses, ensuring every employee meets organizational training requirements.

Advanced Analytics And Performance Insights

e-KHOOL LMS identifies learning gaps with custom reports to help optimize training programs, align them with business goals, and ensure measurable performance improvement..

Measurable Benefits of Finance LMS

Finance and microfinance companies using e-KHOOL finance LMS report stronger employee performance, reduced training costs, and higher compliance accuracy.

55%

Increase in employee productivity and skill accuracy

35%

Reduction in training and operational costs

45%

Improvement in compliance and customer satisfaction outcomes