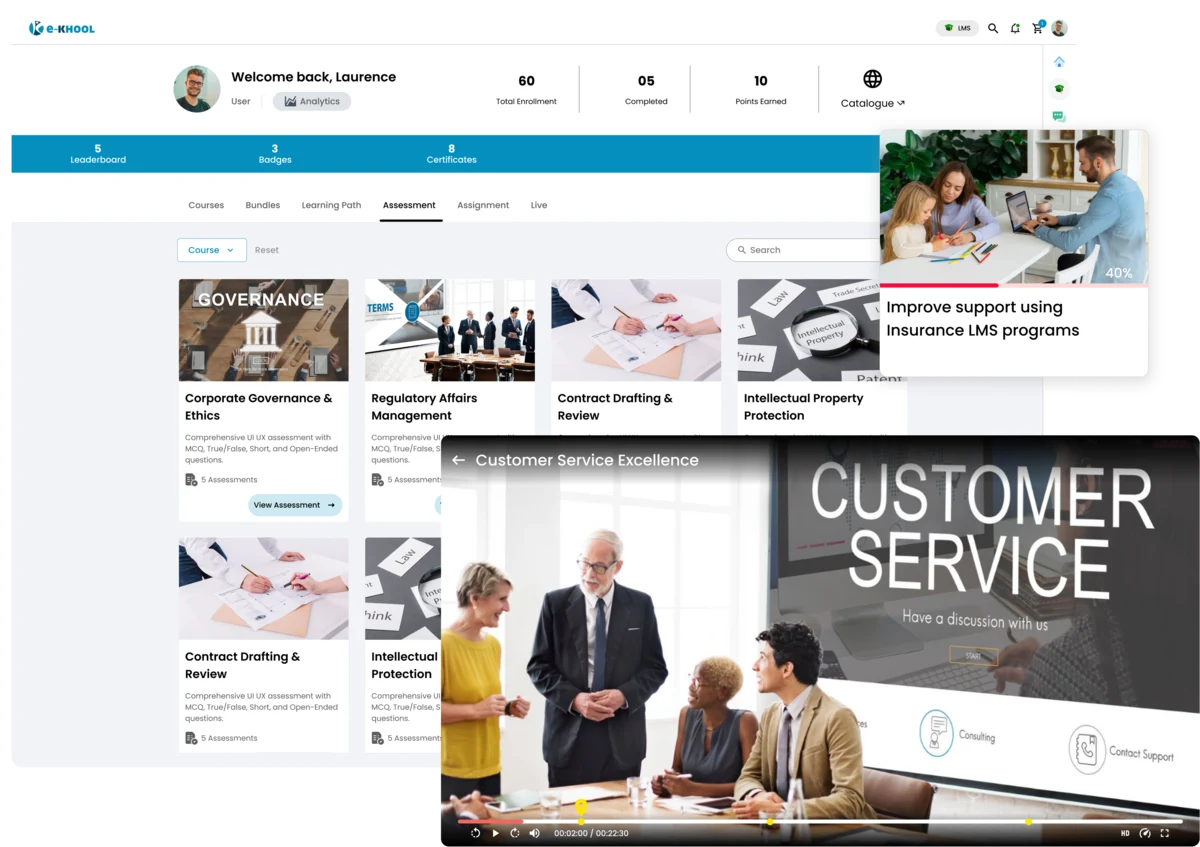

Empowering Every Insurance Workforce with eLearning

e-KHOOL LMS bridges the gap between field learning and regulatory updates, helping insurance companies maintain consistency in compliance and service quality across all departments.

Sales and Marketing Teams

Sales representatives can access dynamic product and market training anytime, ensuring deep understanding of new insurance products and competitive positioning.

Claims and Underwriting Teams

e-KHOOL LMS for insurance companies provides process-oriented training for claims handlers and underwriters to improve risk evaluation and claims accuracy.

Customer Support Teams

The LMS for insurance training helps support teams with training on policy handling. Interactive courses enhance their ability to resolve customer issues efficiently.

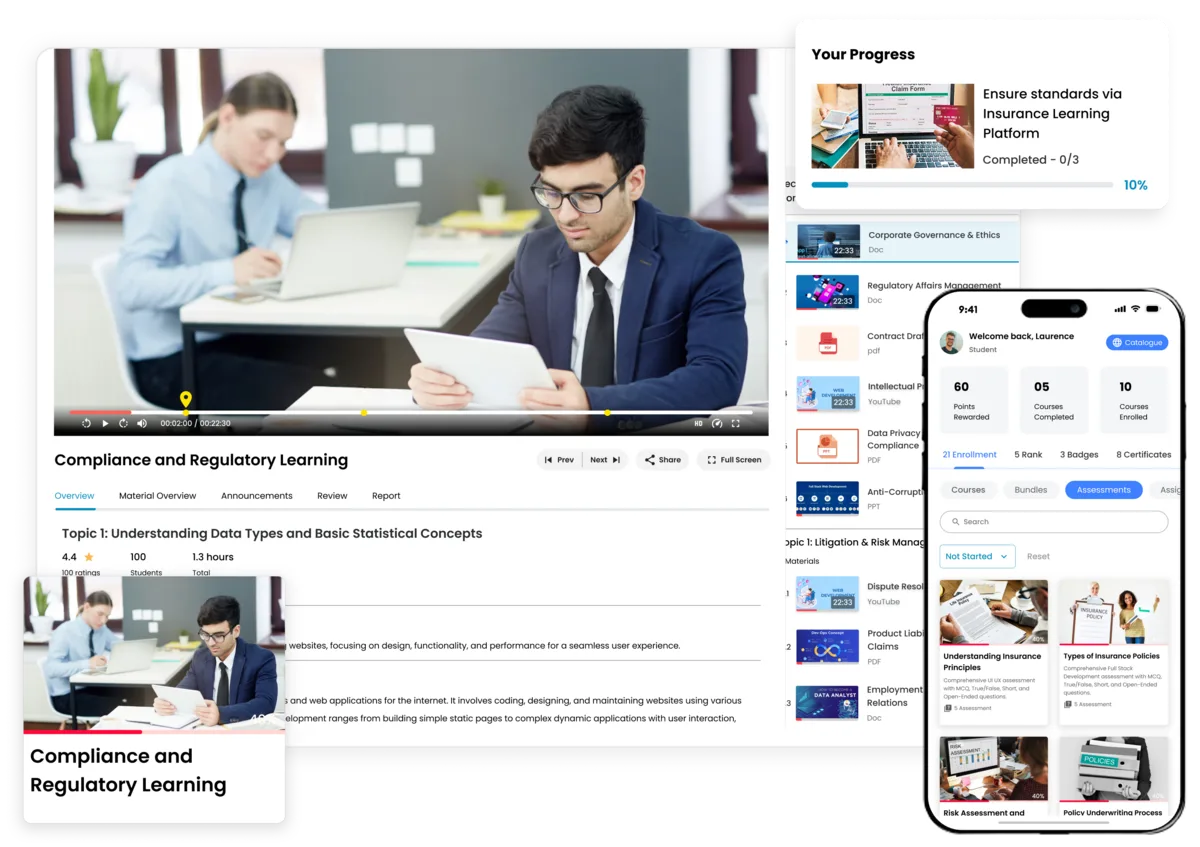

Compliance and Legal Teams

For compliance officers and legal teams, e-KHOOL LMSfor Insurance Sector simplifies the delivery of mandatory training programs on data privacy, AML, and insurance regulations.

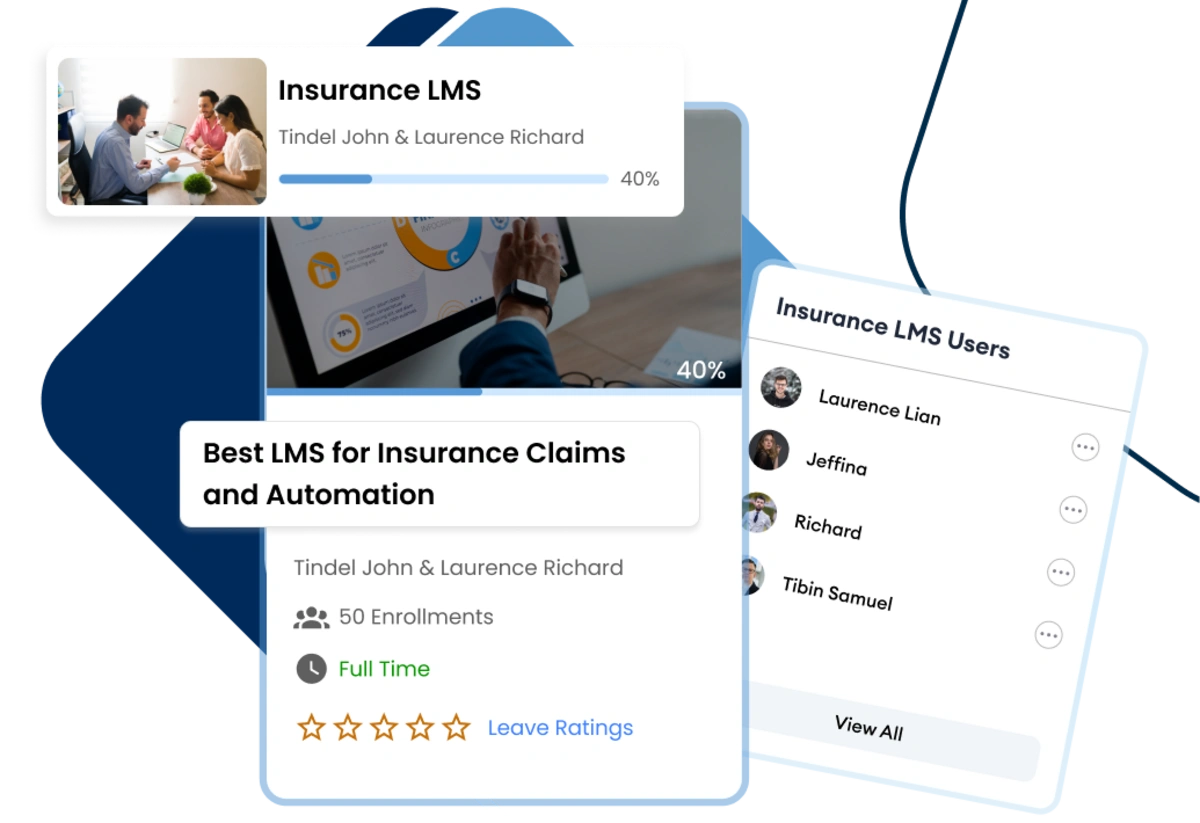

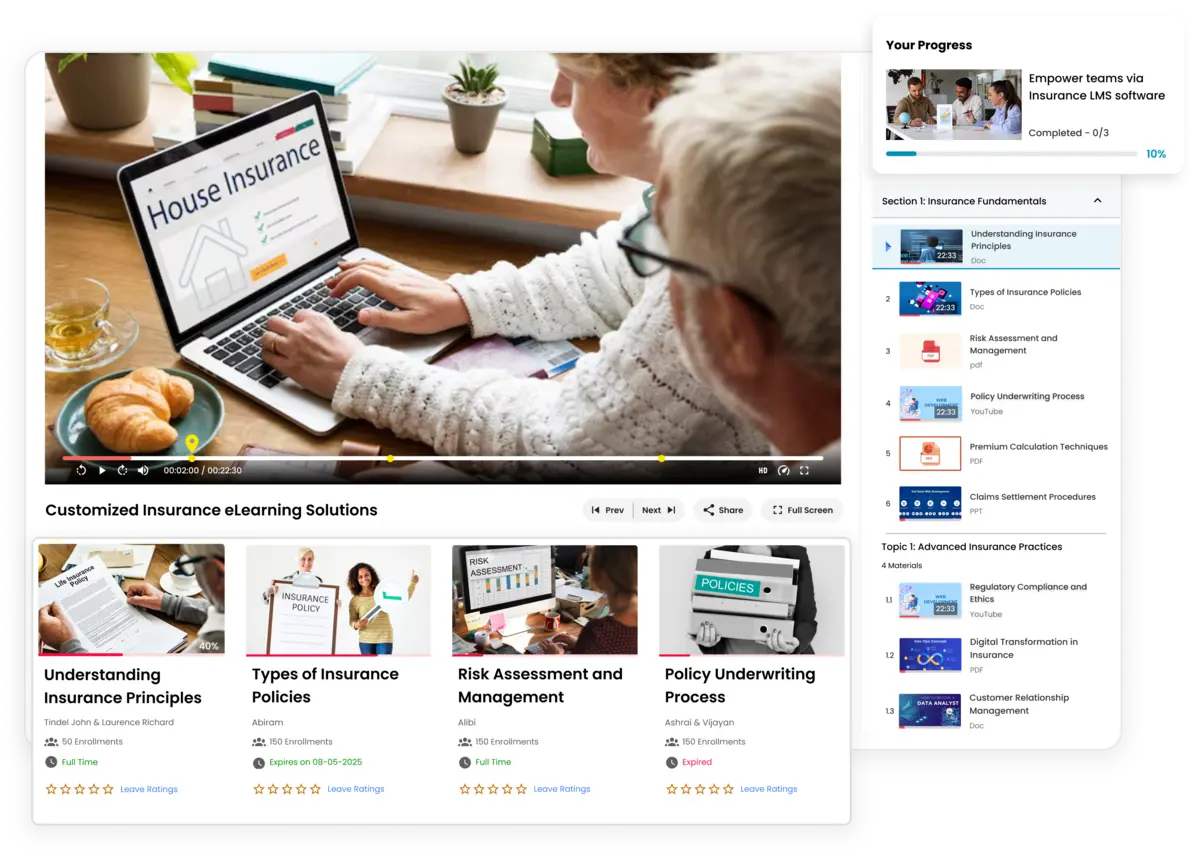

Enhancing Product Knowledge with e-KHOOL LMS

e-KHOOL LMS for insurance training programs supports organizations with comprehensive training that enhance employee skills, ensure compliance, and streamline certification processes.

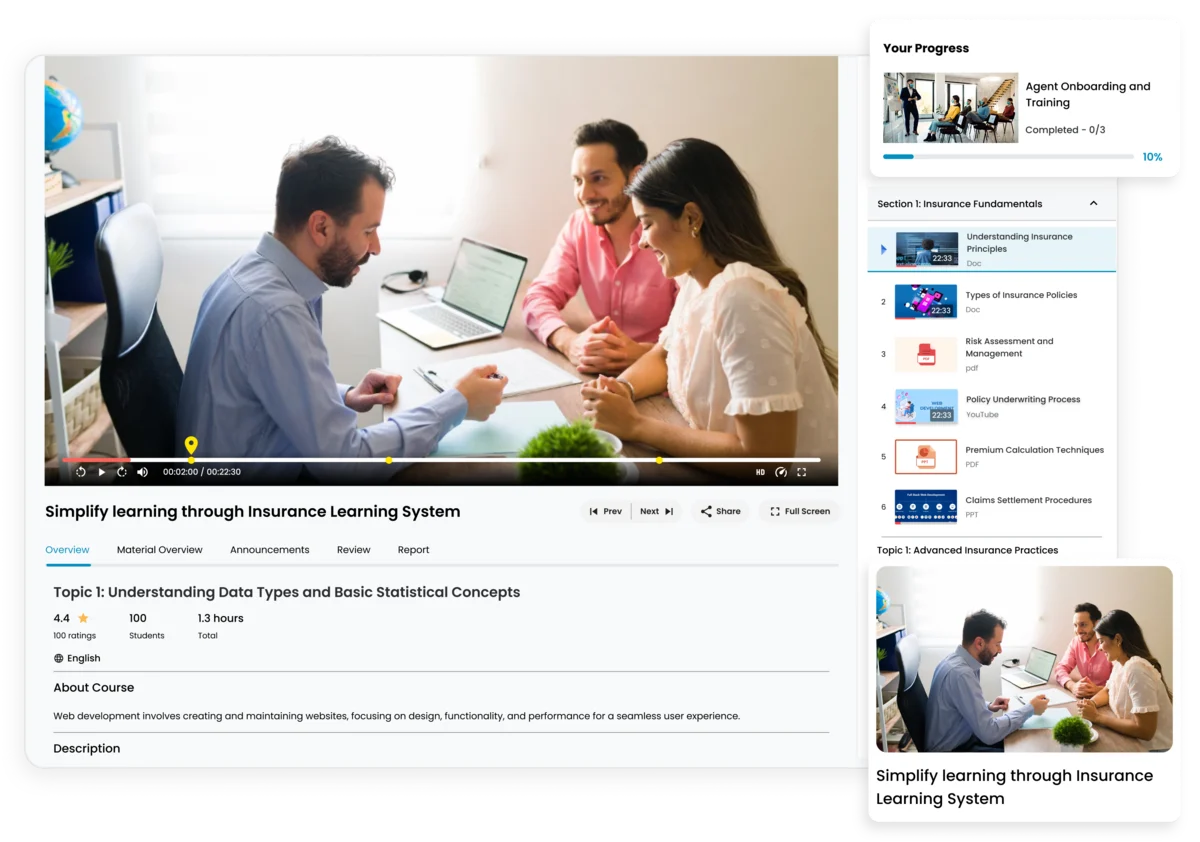

LMS Platform Features Helping Insurance Companies

From policy updates to compliance certifications, every training experience is simplified and measurable in e-KHOOL LMS ensuring scalability, mobile access, and seamless integration.

Centralized Learning Dashboard

Accessing all training materials, reports, and updates in one unified dashboard for tracking courses, completions, and certifications, boosts visibility and operational control across departments.

AI-Driven Course Recommendation

e-KHOOL LMS ensures every insurance employee receives relevant, engaging, and adaptive learning paths that foster faster knowledge retention and improved professional growth.

Compliance Tracking and Reporting

The LMS for Insurance Training provides real-time insights into assessment results, certification renewals, helping compliance officers monitor training records effortlessly..

Multi-Device Accessibility and Scalability

e-KHOOL LMS enables learning anytime, anywhere through web and mobile platforms and scales effortlessly as your insurance network grows, ensuring consistent learning.

Measurable Benefits of LMS for Insurance Sector

With automated training and certification processes, insurance firms can streamline workforce learning, boost profitability, and maintain industry standards with ease.

60%

faster employee onboarding and skill adoption

45%

reduction in compliance management costs

70%

improved sales and service performance outcomes